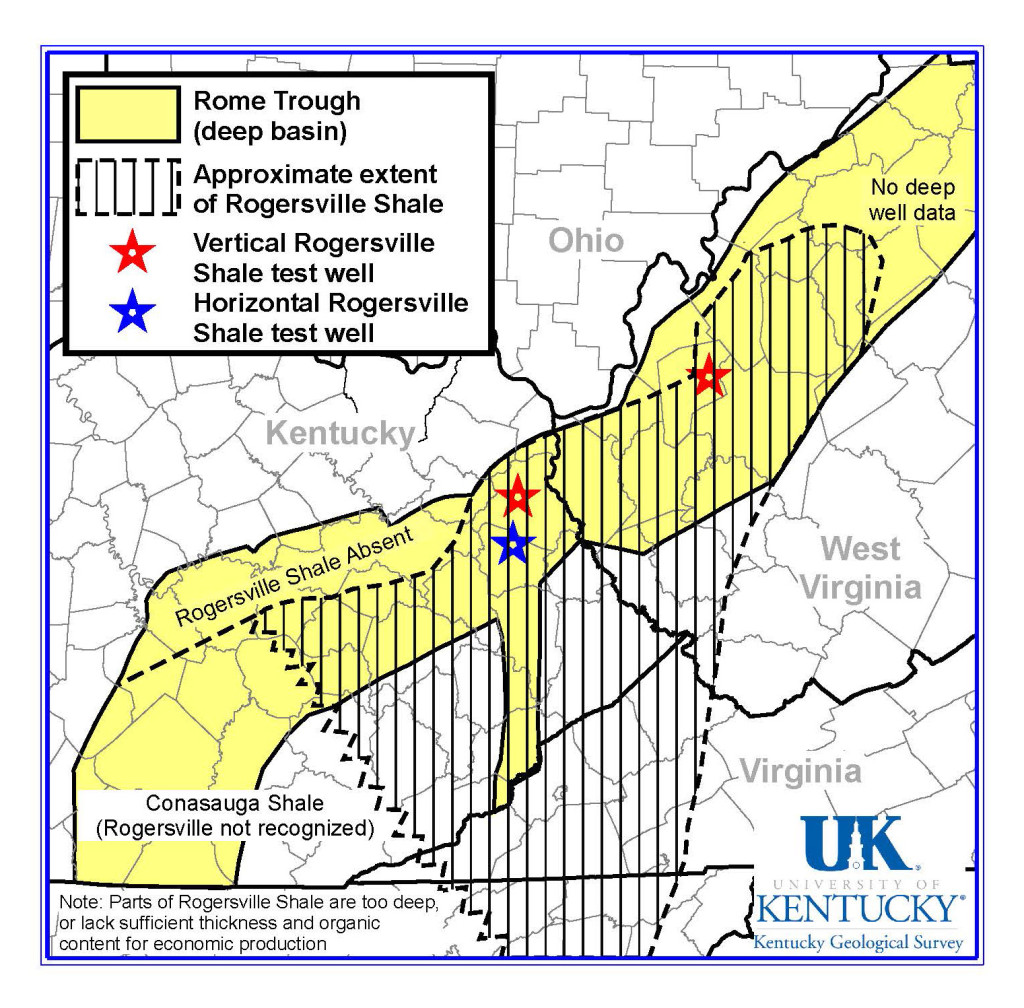

The Herald-Dispatch ran an article by Brandon Roberts today about the Rogersville Shale. We’ve seen an uptick in talk about the Rogersville Shale lately. It seems everybody knows it’s there and it seems everybody is excited about the prospect of developing the Rogersville Shale. It just doesn’t seem like any oil and gas companies are excited about developing the Rogersville Shale right now.

The reason, as pointed out by Corky DeMarco in the article, is that gas prices are just too low for the time being. Once gas gets up to $4.00/MCF again, the Rogersville Shale will get a lot more development. That’s also true of the other shale plays here in West Virginia and around the country.

The only trouble with waiting for gas prices to rise over $4/MCF is that when prices start to approach $4.00 producers are going to start opening up wells that they have shut in. There is a large amount of gas stored in the ground that could be produced but isn’t because prices are so low. That gas will be produced first, and will drive prices down. It’s very unlikely that gas prices are going to go up and stay up for any length of time.

There are a couple of factors on the demand side that could, and will, change this. New power plants coming on line in a few years will drive demand up. New pipelines coming on line in a few years will drive demand up. New cracker plants coming on line in a few years will drive demand up. You’ll notice that the pattern is “in a few years”. Demand is just not increasing right now. It will in a few years.

We don’t expect any wild fluctuations in the price of gas for the time being. Barring a war, a really bad hurricane season, or some other unpredictable catastrophe, things are going to stay pretty much the same for a few years, and the Rogersville Shale will remain relatively untapped.

That puts Cabot Oil and Gas in a pretty good position. They are the one company that is working in the Rogersville Shale area of West Virginia. They are taking some leases and drilling exploratory wells (the Cabot 50 in Putnam County). Cabot could have a big payday when prices rise on natural gas. Here’s to hoping that Cabot continues to work in the area.

I have 1/2 interest in 115 acres of mineral rights in Barbour County, West Virginia and want to sell it. How much is it worth?

I wouldn’t part for mineral rights in Barbour County for less than $4,000/acre. I say that because the bonus you could get for signing a lease there was between $750 and $1500/acre, and even more if you negotiated hard. I would be surprised if you could find somebody to buy it, though. There’s not a huge amount of development going on in Barbour right now. I also recommend that if you’re in a position where you can hold on to your minerals that you do so. They should be more valuable in the long run with bonus amounts and royalties than with a one-time purchase price. If you get an offer and you want to sell I’ll be glad to help you through the negotiating and selling process so that you get the best price possible and don’t get saddled with liabilities.