The Atlantic Coast Pipeline is now offering to buy easements from landowners in Upshur County, West Virginia. The easement includes a 75 foot permanent right of way and a 50 foot temporary right of way. They are offering $42 per foot, which is the old standard of $1.00 per inch per foot.

The ACP is a 42 inch pipeline which originates in Doddridge County and passes through Lewis, Upshur, Randolph, and Pocahontas counties in West Virginia. If you think you might be on the route, you can go to Dominion’s Atlantic Coast Pipeline map page. There are several different types of maps there that you can play with. Most people on the route have been approached with an offer at this point, but I spoke today with a client whose neighbor should be on the route but hasn’t yet been approached by a landman .

.

The ACP is going to have FERC approval, meaning it will have eminent domain powers. The ACP will do their best to put together a deal with a landowner instead of going in front of the courts, though, for two good reasons. One, it’s cheaper to just deal with the landowner. Two, the rights they get in a court order are usually more limited than what they can negotiate with a typical landowner.

This means that you will have a chance to negotiate for a good deal. You can get a better price for your property, but more importantly you can also get much better terms. The ACPs easement agreement isn’t as comprehensive as the Mountain Valley Pipeline’s, but it still needs some important changes.

Make sure the easement can’t be moved without your approval. You don’t want to grant them an easement based off a landman’s verbal assurances or even a preliminary map. The location has to be clearly marked and any changes must be made in writing.

Make sure you can use the easement for whatever you want so long as it doesn’t interfere with the pipeline’s safe function. The easement states nearly the opposite, limiting your ability to use the easement to a number of specific items.

Make sure that if the easement is no longer being used by them that it reverts back to you. As written, the easement agreement is permanent, even if the pipeline is no longer being used. You probably won’t see the day the pipeline stops carrying gas, but your grandkids might, and they’ll thank you for your foresight.

Make sure they pay you a lot more than they’ve offered. The new standard in West Virginia is $2.00 per inch per foot, but if you get onto some online forums you’ll find people who are talking about getting $4.00-$5.00 per inch per foot, which would equal $168-$210 per foot for a 42 inch pipeline. While we haven’t seen those number materialize yet (it’s all just speculation) we’d like to see better than $1 per inch per foot.

There are a number of other things you might want to ask for, including the right to cross the pipeline with heavy equipment, a specific type of fence around the easement, special treatment for timber, avoiding certain areas of your property, gates in specific locations, limits to their ability to use your existing roads, and a prohibition against their workers hunting, fishing, camping, or doing any other activities on your land.

We are putting together a group to negotiate with the ACP. You can join and leave any time you want. With a large number of landowners we can get more concessions, including more money, from the ACP. Call if you would like to be part of it. 304-473-1403.

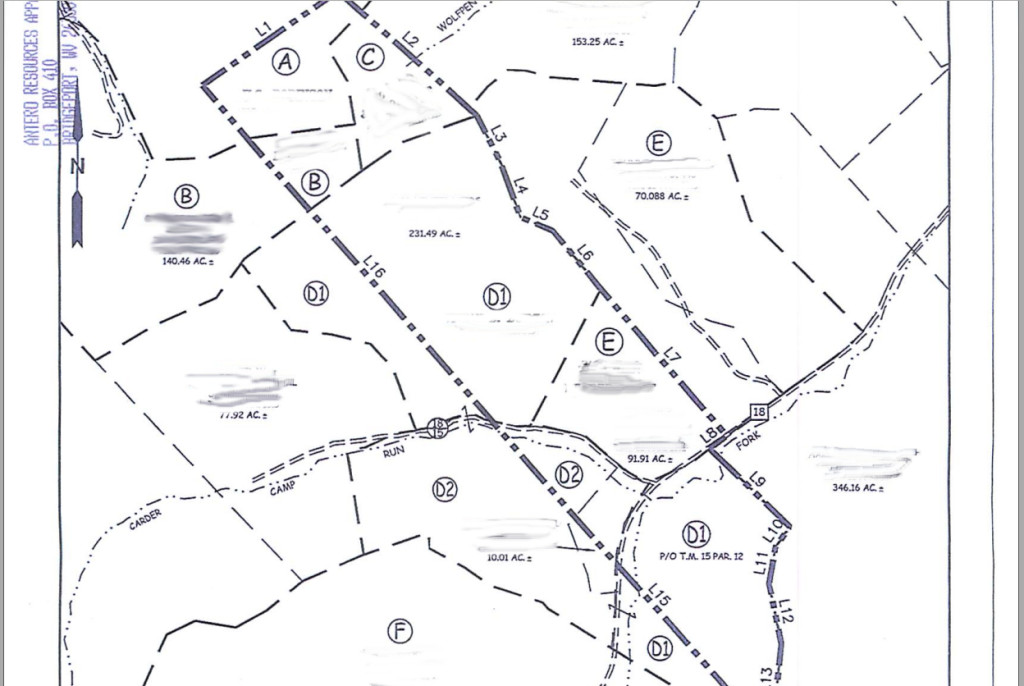

Once you’ve started talking with a landman about an oil and gas lease or a modification or amendment of an old oil and gas lease, it usually won’t take long before the term “pooling” or “pool” or “unit” or “unitization” comes up. A lot of landmen will throw the word out, just expecting you to understand it. They use the term all the time, so they might not even realize that they just said something that doesn’t make any sense to you in context. “What does a swimming pool have to do with my oil and gas rights?” you think to yourself, but the landman is moving on to something else and you just move right along with him. It never really gets explained sometimes.

Once you’ve started talking with a landman about an oil and gas lease or a modification or amendment of an old oil and gas lease, it usually won’t take long before the term “pooling” or “pool” or “unit” or “unitization” comes up. A lot of landmen will throw the word out, just expecting you to understand it. They use the term all the time, so they might not even realize that they just said something that doesn’t make any sense to you in context. “What does a swimming pool have to do with my oil and gas rights?” you think to yourself, but the landman is moving on to something else and you just move right along with him. It never really gets explained sometimes.