In November of 2014, Saudi Arabia announced that it would not cut production of oil. This surprised everyone, as the price of oil had fallen quite a bit at that point, and Saudi Arabia’s usual move when oil prices had fallen in the past had been to cut production. The result — oil prices fell even further.

There was a lot of speculation as to why Saudi Arabia wasn’t cutting prices. Most people thought that it was a move to hurt Russia, Iran, and Venezuela. Some people thought it was a move to kill fracking in the US.

More and more, people have decided that while hurting Russia, Iran, and Venezuela was a nice bonus, the real target was US fracking.

While fracking has suffered, it hasn’t died. This article over at biznews.com explains why. The short story — US frackers figured out how to cut costs. A lot. The article says that costs of various drilling services have fallen by 20 percent to 50 percent, and that some oil plays now have a break even point below $40/bbl.

That’s what entrepreneurs and CEOs do when they operate in a free market. The Saudis didn’t count on that, and I don’t think anybody outside the US really believed it could be done. We did it.

The fascinating thing for West Virginia oil and gas royalty and mineral rights owners is that bonus amounts and royalty amounts really haven’t changed much since November of 2014. Royalty amounts haven’t dropped at all. Bonus amounts have dropped some. For instance, you can still get a lease for $2,500 per acre in Doddridge and Harrison counties, but you will have a harder time getting that for a lease in Ritchie County which was commanding even more than that at one point. In Tyler County you can still get $4,000 per acre, and in Wetzel and Marshall counties you can get anywhere between $2,500 and $4,000 per acre.

Some counties have no development at all now, but it’s more because the formations under those counties are not expected to produce as much gas as other counties. Those counties will be exploited (word choice purposefully made) in later months or years when gas has been fully exploited elsewhere.

The one real change that we’ve seen in West Virginia is that, while the price of an acre hasn’t dropped much, the sheer number of lease offers has. Instead, we’re talking with more people who have been given offers to buy their mineral rights. While we’re glad to help facilitate those sales in the right circumstances, we still recommend that people hold on to their mineral rights if they are in a position to do so. Those mineral rights will be more valuable when the lease buyer comes knocking than when the mineral buyer comes calling.

We still think that in a few years the infrastructure for gas delivery will improve, the demand for gas will go up, and the price of gas will go up. At that point leasing will pick up again.

For those of you thinking about whether to lease or sell, give us a call and we’ll help you decide what’s best for you. In the meantime, celebrate the exceptionalism of the American free market over the 4th of July weekend.

And be safe.

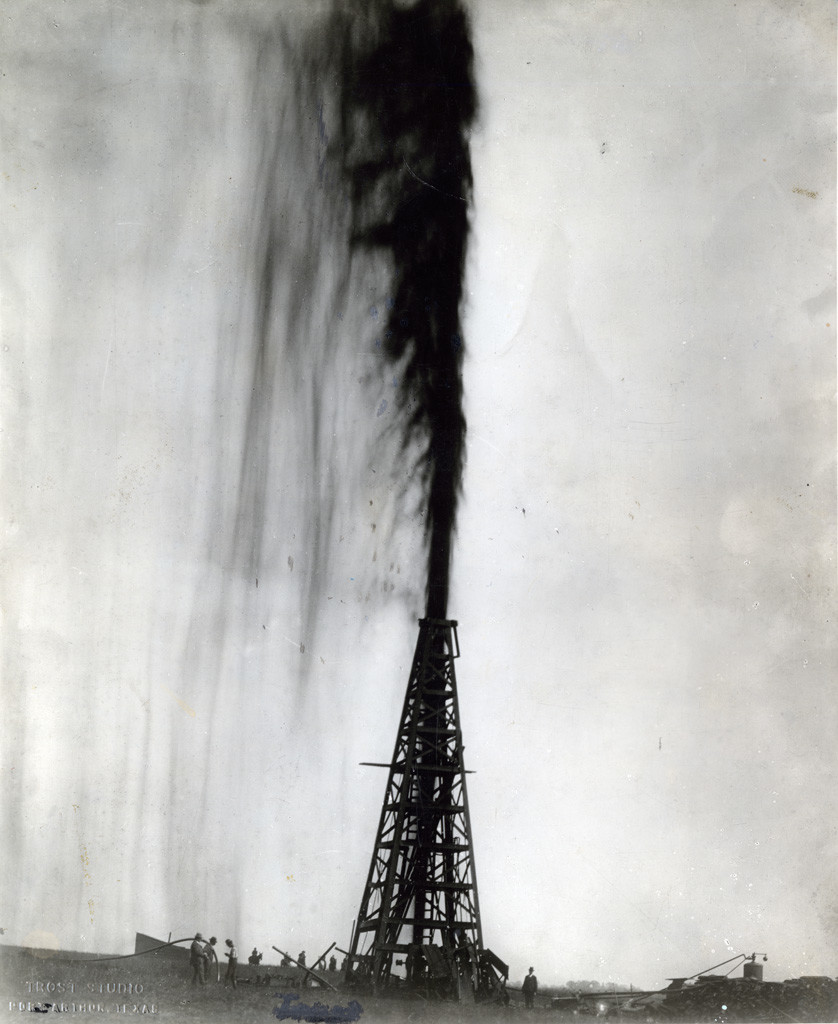

We’re not sure how this happens, but a new pipeline at a drilling site in Tyler County, West Virginia,

We’re not sure how this happens, but a new pipeline at a drilling site in Tyler County, West Virginia,