Natural gas prices are at $4.26/MMBtu, having hit a low of $3.56 on December 30, and a high of $4.86 on January 12. Rig counts are at 601, up 25. Gas storage numbers are down, and right at the five year average. With some cold weather coming up, gas prices will probably go up a bit.

Landowners challenging the Mountain Valley Pipeline’s use of eminent domain are arguing that the “non-delegation doctrine” should be applied here. If that happened here, the precedent would affect the way other Federal agencies operate, possibly making it so that our country would have far fewer regulations, but possibly giving us far more laws. I doubt this challenge will succeed, but it would be absolutely fascinating to watch the fallout if it did. It would be one of the most important cases of our lifetime.

LNG exports continue to pick up, hitting a record of 13 billion cubic feet per day. At least some of that gas comes from the Marcellus shale and West Virginia.

The Mountain Valley Pipeline has received approval from West Virginia to proceed with construction across streams and wetlands. This will probably be the last legal challenge that MVP will face in West Virginia, but who knows? Environmentalists have proven tenacious, to say the least. MVP currently expects to be in operation by this summer (2022).

RBNEnergy reviewed their predictions for 2021, and made new predictions for 2022. This always makes for good reading.

There was an explosion and fire at a compressor station in Pennsylvania. Nobody was hurt, and only a little grass was burned. As far as natural gas accidents go, this was a tame one.

The increased buildout of liquefaction plants has increased the amount of LNGs we can export. Consequently, the domestic price of natural gas is becoming more and more tied to the price of natural gas in foreign markets. Foreign markets are more volatile than ours, so we can expect that our prices are going to become more volatile as well.

Here’s a Forbes article about why we aren’t going to have all-renewable energy in the very near future.

And just like that, West Virginia’s decision to approve MVP’s permit has been challenged.

About 65% of oil and gas executives surveyed believe that natural gas prices will average somewhere between $3.50/MMBtu and $4.50/MMBtu over the 2022 calendar year.

Libya had scheduled elections, but they were canceled and there’s no certainty as to when they will happen. The threat of civil war is looming again, and as a consequence, oil production is down again.

OPEC+ has agreed to increase crude oil output by 400,000 barrels per day starting in February.

The West Virginia DEP has issued a construction permit for a natural gas fired power plant. It will be an expansion of an existing coal fired power plant just north of Morgantown, West Virginia. This is the kind of thing we need in West Virginia. Pervious efforts to build natural gas fired power plants have been slow to develop, even being opposed by Jim Justice, our current governor and coal company operator. West Virginia needs to add value to the natural gas produced here instead of shipping it elsewhere to be turned into energy or other industrial uses.

EOG Resources, one of the big oil producers, has said it could move back into growth mode, depending on macro-economic factors. It will be interesting to see whether other producers follow suit.

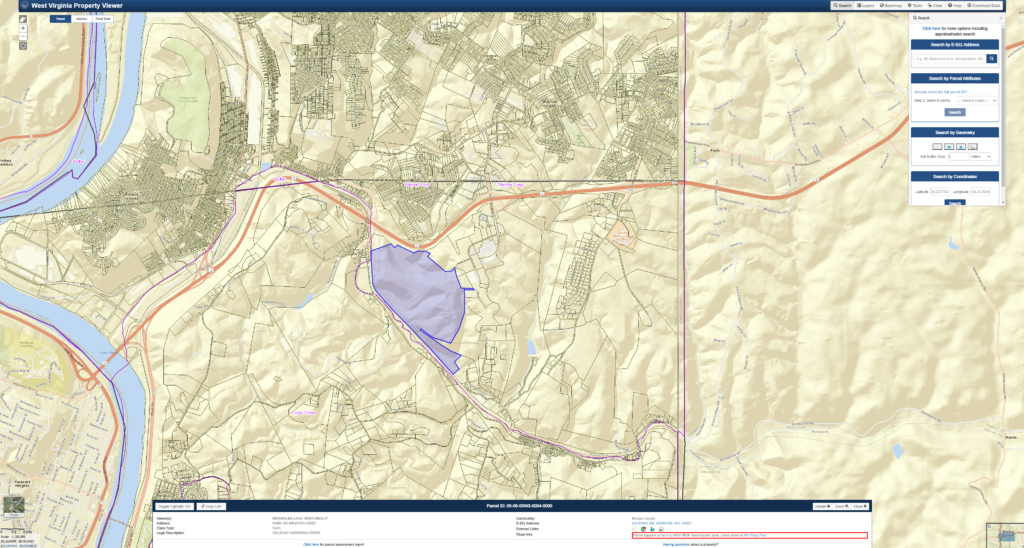

The discussion about West Virginia’s new tax rule for valuing oil and gas production is providing us more detail about what’s wrong with the new rule. Apparently there’s a “reasonableness” standard involved, and the legislature never intended for there to be a reasonableness standard. That’s awkward.

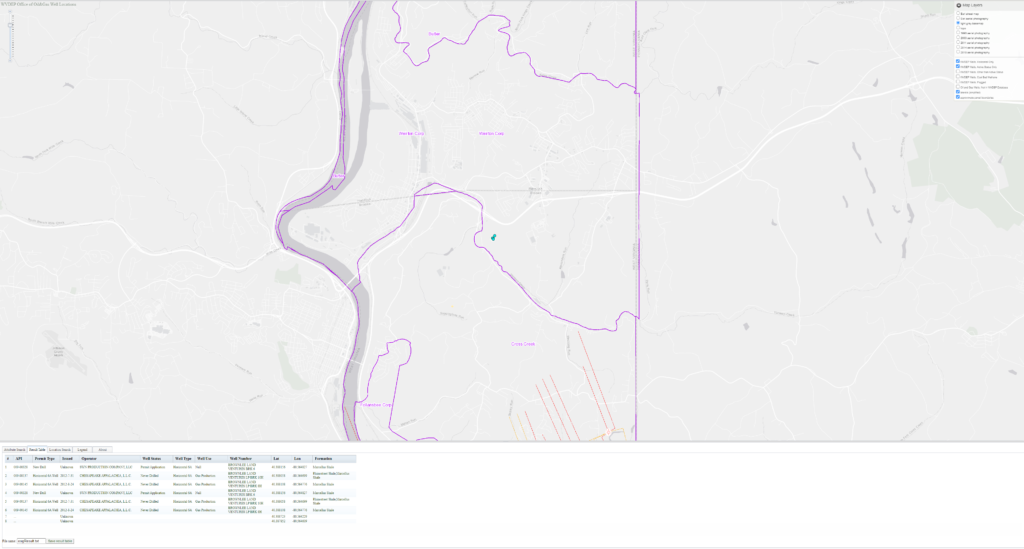

An article at NGI describes ongoing projects and challenges in the Marcellus/Utica region. It’s a pretty good overview of big picture items.

Libyan oil output is rebounding.

One West Virginia legislator is pushing for oil and gas companies to automatically deduct income taxes from royalty owners’ checks. She thinks that out-of-state owners are not paying West Virginia income taxes. She’s probably right.

By the way, the West Virginia legislature is in session, and we’ll keep an eye out for other stories that may impact West Virginia mineral and royalty owners.