This presentation was made to the West Virginia Land and Mineral Owners Association by Philip A. Dinterman in 2017. The slides include a lot of information, but it sure would have been interesting to hear the actual presentation and discussion. The long and short of it is that the Rogersville Shale is very likely to produce a lot of natural gas when companies get around to drilling into it, but it’s very expensive and hasn’t been well explored as yet so companies are hesitant to throw a lot of resources at it.

Category Archives: Rogersville Shale

There’s a New Rogersville Shale Test Well

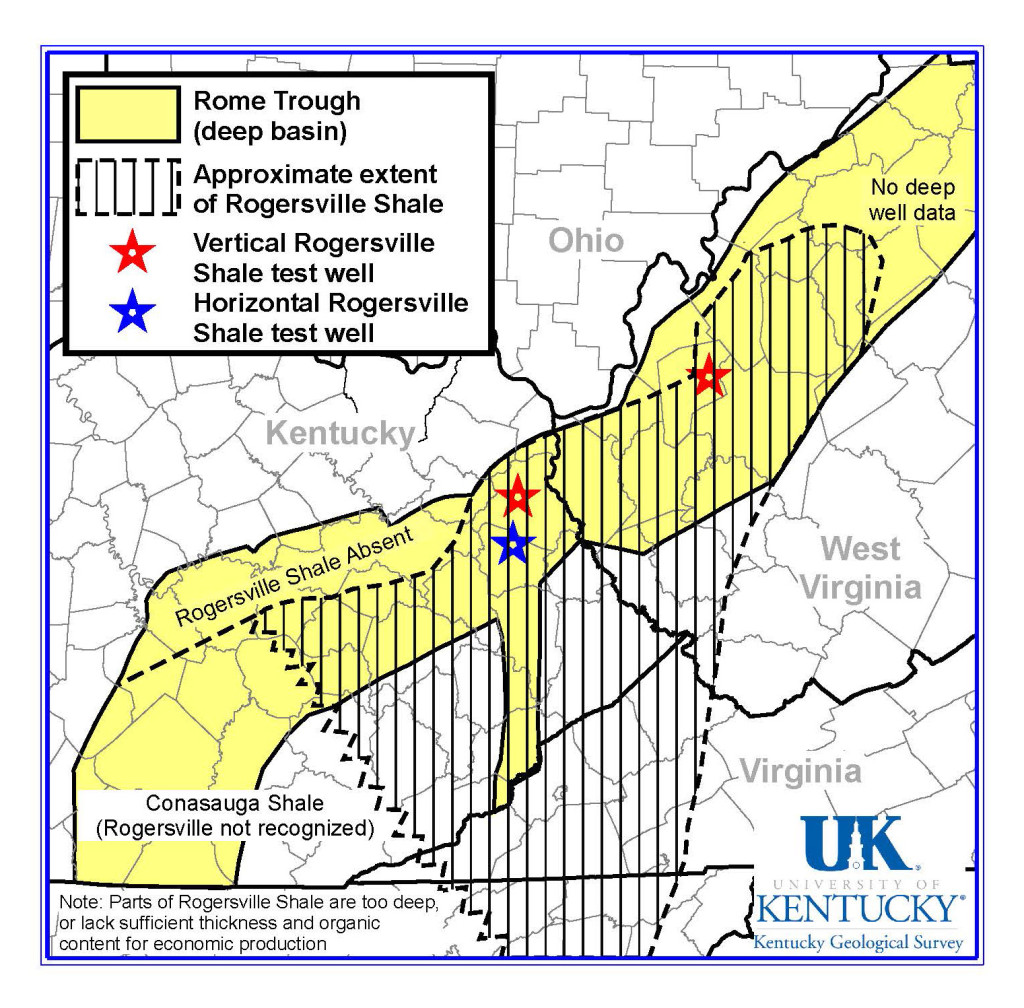

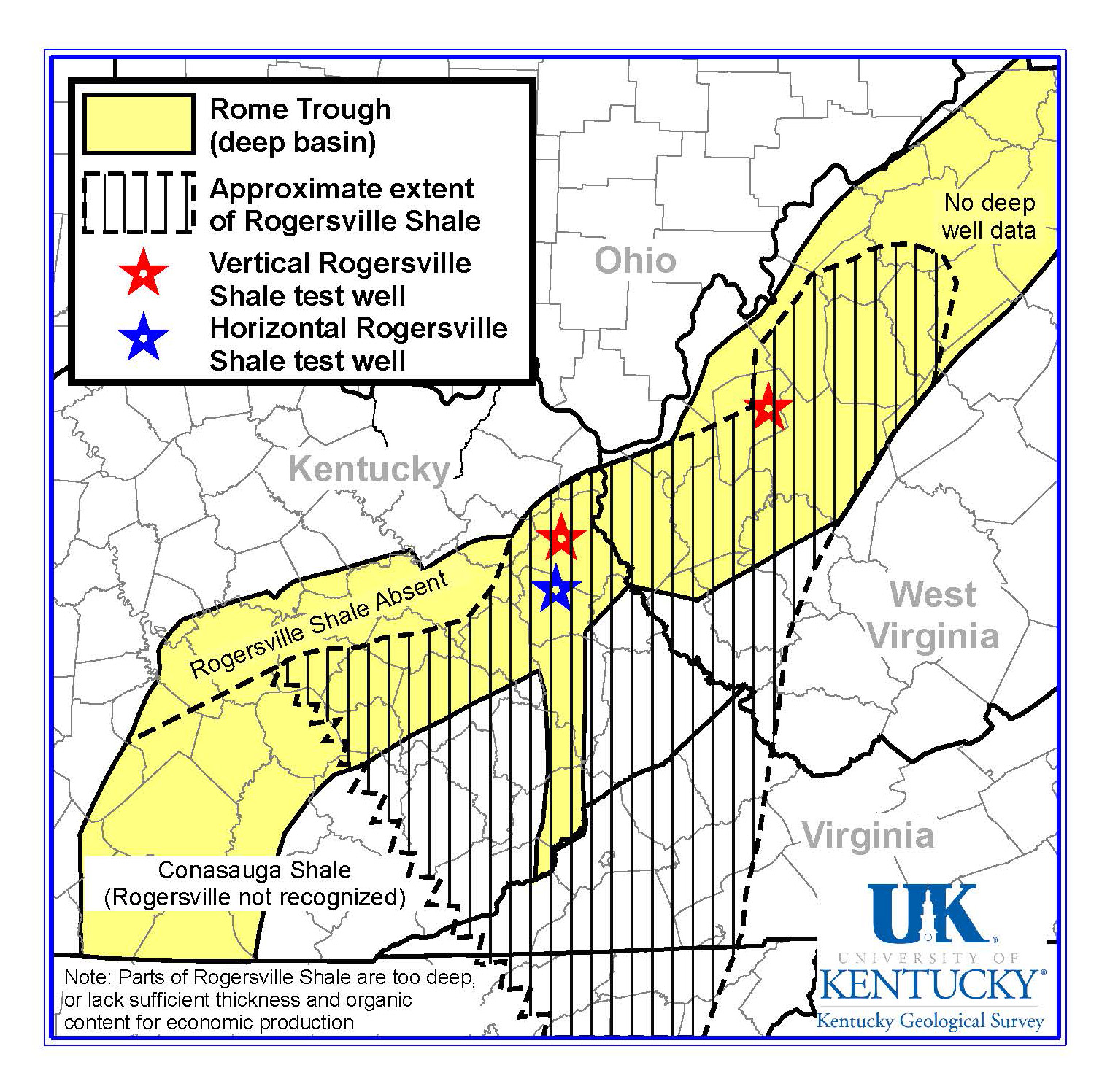

Hard Rock Exploration has acquired a permit to drill a test well to the Rogersville Shale. It will be south of Winfield, WV. For some reason, this area is very interesting to oil and gas companies. Cabot has already drilled the Cabot 50 well to the Rogersville just to the north of Winfield.

Rogersville Test Well a Bust at First Glance

A test well drilled to the Rogersville shale in Kentucky has apparently produced very little, just 19 barrels per day of oil and 115 MCF per day of gas. That would be end of story for the Rogersville shale if those numbers were the whole story.

Companies are exploring the Rogersville shale right now because of test wells that were done in the 1960s and 1970s which produced 10,000 barrels of oil (not per day) and 6-9 MCF per day of gas. So why did this well get such poor results? It’s a vertical well, and it hit a bad spot in the Rogersville shale.

The Marcellus shale used to be a formation that would yield dry holes. Some vertical wells to the Marcellus produced like gangbusters, others didn’t produce a thing. Horizontal drilling changed that. The horizontal portion of the well passes through rock that doesn’t produce and through rock that does produce, and the end product is a well that produces a lot of gas.

So the Rogersville shale still has potential, and will probably be a great formation to develop. It’s going to be expensive, at $18-$30 million per well, but it will also give some really awesome production when horizontal drilling starts.

Rogersville Shale: Holding Pattern

The Herald-Dispatch ran an article by Brandon Roberts today about the Rogersville Shale. We’ve seen an uptick in talk about the Rogersville Shale lately. It seems everybody knows it’s there and it seems everybody is excited about the prospect of developing the Rogersville Shale. It just doesn’t seem like any oil and gas companies are excited about developing the Rogersville Shale right now.

The reason, as pointed out by Corky DeMarco in the article, is that gas prices are just too low for the time being. Once gas gets up to $4.00/MCF again, the Rogersville Shale will get a lot more development. That’s also true of the other shale plays here in West Virginia and around the country.

The only trouble with waiting for gas prices to rise over $4/MCF is that when prices start to approach $4.00 producers are going to start opening up wells that they have shut in. There is a large amount of gas stored in the ground that could be produced but isn’t because prices are so low. That gas will be produced first, and will drive prices down. It’s very unlikely that gas prices are going to go up and stay up for any length of time.

There are a couple of factors on the demand side that could, and will, change this. New power plants coming on line in a few years will drive demand up. New pipelines coming on line in a few years will drive demand up. New cracker plants coming on line in a few years will drive demand up. You’ll notice that the pattern is “in a few years”. Demand is just not increasing right now. It will in a few years.

We don’t expect any wild fluctuations in the price of gas for the time being. Barring a war, a really bad hurricane season, or some other unpredictable catastrophe, things are going to stay pretty much the same for a few years, and the Rogersville Shale will remain relatively untapped.

That puts Cabot Oil and Gas in a pretty good position. They are the one company that is working in the Rogersville Shale area of West Virginia. They are taking some leases and drilling exploratory wells (the Cabot 50 in Putnam County). Cabot could have a big payday when prices rise on natural gas. Here’s to hoping that Cabot continues to work in the area.

Cabot and the Rogersville Shale in West Virginia

The Charleston Gazette ran an article about possible development of the Rogersville shale in the western part of West Virginia. Cabot Oil and Gas has been drilling the Cabot 50 in Putnam County for some time, and speculation is that it’s a good well. Unfortunately, due to the downturn in the price of oil and gas, it’s unlikely that we’ll see any serious development of the Rogersville shale before the end of 2015. As prices start to rise, I expect interest in the Rogersville shale to also rise.

Interestingly, there are at least two other formations that could turn out to be producible in that part of West Virginia. They are the Trenton-Black River formation and the Loysburg formation. They’re located in the Rome Trough, which seems to run pretty much in the same area where the maps we’ve seen are showing the Rogersville shale. There’s a pretty good, if short, discussion from 2013 on the Go Marcellus Shale website about development of those formations over in New York.